Track Your Refund

When will you receive your refund? The answer depends on how you filed your return. The IRS should issue your refund check within six to eight weeks of filing a paper return. If you chose to receive your refund through direct deposit, you should receive it within a week. If you use e-file, your refund should be issued between two and three weeks.

Tax Due Dates

June 2023

June 12

Employees - who work for tips. If you received $20 or more in tips during May, report them to your employer. You can use Form 4070.

June 15

Individuals - If you are a U.S. citizen or resident alien living and working (or on military duty) outside the United States and Puerto Rico, file Form 1040 or Form 1040-SR and pay any tax, interest, and penalties due. If you want additional time to file your return, file Form 4868 to obtain 4 additional months to file. Then file Form 1040 or Form 1040-SR by October 16.

However, if you are a participant in a combat zone you may be able to further extend the filing deadline.

Individuals - Make a payment of your 2023 estimated tax if you are not paying your income tax for the year through withholding (or will not pay in enough tax that way). Use Form 1040-ES. This is the second installment date for estimated tax in 2023.

Corporations - Deposit the second installment of estimated income tax for 2023. A worksheet, Form 1120-W, is available to help you estimate your tax for the year.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in May.

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in May.

July 2023

July 10

Employees - who work for tips. If you received $20 or more in tips during June, report them to your employer. You can use Form 4070.

July 17

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in June.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in June.

July 31

Employers - Federal unemployment tax. Deposit the tax owed through June if more than $500.

Employers - If you maintain an employee benefit plan, such as a pension, profit sharing, or stock bonus plan, file Form 5500 or 5500-EZ for calendar year 2022. If you use a fiscal year as your plan year, file the form by the last day of the seventh month after the plan year ends.

Certain Small Employers - Deposit any undeposited tax if your tax liability is $2,500 or more for 2023 but less than $2,500 for the second quarter.

Employers - Social Security, Medicare, and withheld income tax. File Form 941 for the second quarter of 2023. Deposit any undeposited tax. (If your tax liability is less than $2,500, you can pay it in full with a timely filed return.) If you deposited the tax for the quarter in full and on time, you have until August 10 to file the return.

August 2023

August 10

Employees - who work for tips. If you received $20 or more in tips during July, report them to your employer. You can use Form 4070.

Employers - Social Security, Medicare, and withheld income tax. File Form 941 for the second quarter of 2023. This due date only applies if you deposited the tax for the quarter timely, properly, and in full.

August 15

Employer - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in July.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in July.

August 2023

September 11

Employees - who work for tips. If you received $20 or more in tips during August, report them to your employer. You can use Form 4070.

September 15

Individuals - Make a payment of your 2023 estimated tax if you are not paying your income tax for the year through withholding (or will not pay in enough tax that way). Use Form 1040-ES. This is the third installment date for estimated tax in 2023.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in August.

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in August.

S Corporations - File a 2022 calendar year income tax return (Form 1120S) and pay any tax due. This due date applies only if you timely requested an automatic 6-month extension. Provide each shareholder with a copy of Schedule K-1 (Form 1120S) or a substitute Schedule K-1.

Partnerships - File a 2022 calendar year return (Form 1065). This due date applies only if you were given an additional 6-month extension. Provide each partner with a copy of Schedule K1 (Form 1065) or a substitute Schedule K1.

Corporations - Deposit the third installment of estimated income tax for 2023. A worksheet, Form 1120-W, is available to help you make an estimate of your tax for the year.

October 2023

October 10

Employees - who work for tips. If you received $20 or more in tips during September, report them to your employer. You can use Form 4070.

October 16

Individuals - If you have an automatic 6-month extension to file your income tax return for 2022, file Form 1040 or Form 1040-SR and pay any tax, interest, and penalties due.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in September.

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in September.

Corporations - File a 2022 calendar year income tax return (Form 1120) and pay any tax, interest, and penalties due. This due date applies only if you timely requested an automatic 6-month extension.

October 31

Employers - Social Security, Medicare, and withheld income tax. File Form 941 for the third quarter of 2023. Deposit any undeposited tax. (If your tax liability is less than $2,500, you can pay it in full with a timely filed return.) If you deposited the tax for the quarter in full and on time, you have until November 13 to file the return.

Certain Small Employers - Deposit any undeposited tax if your tax liability is $2,500 or more for 2023 but less than $2,500 for the third quarter.

Employers - Federal Unemployment Tax. Deposit the tax owed through September if more than $500.

November 2023

During November

Employers - Income tax withholding. Encourage employees to fill out a new Form W-4 for 2024 if they experienced any personal or financial changes. The 2023 revision of Form W-4 will be available on the IRS website by mid-December.

November 13

Employees - who work for tips. If you received $20 or more in tips during October, report them to your employer. You can use Form 4070.

Employers - Social Security, Medicare, and withheld income tax. File Form 941 for the third quarter of 2023. This due date only applies if you deposited the tax for the quarter timely, properly, and in full.

November 15

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in October.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in October.

December 2023

December 11

Employees - who work for tips. If you received $20 or more in tips during November, report them to your employer. You can use Form 4070.

December 15

Corporations - Deposit the fourth installment of estimated income tax for 2023. A worksheet, Form 1120-W, is available to help you estimate your tax for the year.

Employers - Social Security, Medicare, and withheld income tax. If the monthly deposit rule applies, deposit the tax for payments in November.

Employers - Nonpayroll withholding. If the monthly deposit rule applies, deposit the tax for payments in November.

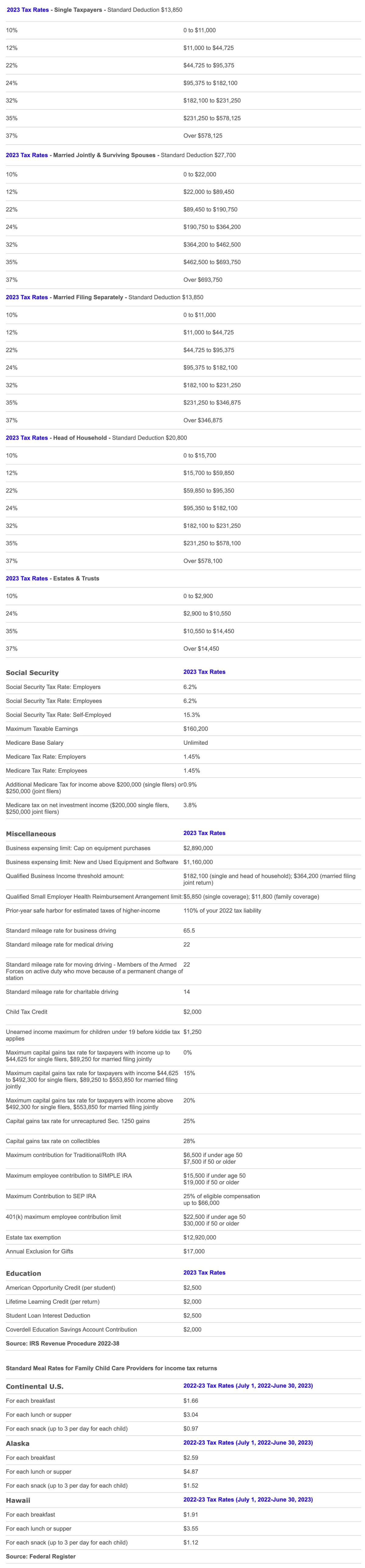

Tax Rates

Record Retention Guide

Storing tax records: How long is long enough?

Federal law requires you to maintain copies of your tax returns and supporting documents for three years. This is called the "three-year law" and leads many people to believe they're safe provided they retain their documents for this period of time.

However, if the IRS believes you have significantly underreported your income (by 25 percent or more), or believes there may be indication of fraud, it may go back six years in an audit. To be safe, use the following guidelines.

Create a Backup Set of Records and Store Them Electronically. Keeping a backup set of records -- including, for example, bank statements, tax returns, insurance policies, etc. -- is easier than ever now that many financial institutions provide statements and documents electronically, and much financial information is available on the Internet.

Even if the original records are provided only on paper, they can be scanned and converted to a digital format. Once the documents are in electronic form, taxpayers can download them to a backup storage device, such as an external hard drive, or burn them onto a CD or DVD (don't forget to label it).

You might also consider online backup, which is the only way to ensure that data is fully protected. With online backup, files are stored in another region of the country, so that if a hurricane or other natural disaster occurs, documents remain safe.

Caution: Identity theft is a serious threat in today's world, and it is important to take every precaution to avoid it. After it is no longer necessary to retain your tax records, financial statements, or any other documents with your personal information, you should dispose of these records by shredding them and not disposing of them by merely throwing them away in the trash.

Business Documents To Keep For One Year

Correspondence with Customers and Vendors

Duplicate Deposit Slips

Purchase Orders (other than Purchasing Department copy)

Receiving Sheets

Requisitions

Stenographer's Notebooks

Stockroom Withdrawal Forms

Business Documents To Keep For Three Years

Employee Personnel Records (after termination)

Employment Applications

Expired Insurance Policies

General Correspondence

Internal Audit Reports

Internal Reports

Petty Cash Vouchers

Physical Inventory Tags

Savings Bond Registration Records of Employees

Time Cards For Hourly Employees

Business Documents To Keep For Six Years

Accident Reports, Claims

Accounts Payable Ledgers and Schedules

Accounts Receivable Ledgers and Schedules

Bank Statements and Reconciliations

Cancelled Checks

Cancelled Stock and Bond Certificates

Employment Tax Records

Expense Analysis and Expense Distribution Schedules

Expired Contracts, Leases

Expired Option Records

Inventories of Products, Materials, Supplies

Invoices to Customers

Notes Receivable Ledgers, Schedules

Payroll Records and Summaries, including payment to pensioners

Plant Cost Ledgers

Purchasing Department Copies of Purchase Orders

Sales Records

Subsidiary Ledgers

Time Books

Travel and Entertainment Records

Vouchers for Payments to Vendors, Employees, etc.

Voucher Register, Schedules

Business Records To Keep Forever

While federal guidelines do not require you to keep tax records "forever," in many cases there will be other reasons you'll want to retain these documents indefinitely.

Audit Reports from CPAs/Accountants

Cancelled Checks for Important Payments (especially tax payments)

Cash Books, Charts of Accounts

Contracts, Leases Currently in Effect

Corporate Documents (incorporation, charter, by-laws, etc.)

Documents substantiating fixed asset additions

Deeds

Depreciation Schedules

Financial Statements (Year End)

General and Private Ledgers, Year End Trial Balances

Insurance Records, Current Accident Reports, Claims, Policies

Investment Trade Confirmations

IRS Revenue Agents' Reports

Journals

Legal Records, Correspondence and Other Important Matters

Minute Books of Directors and Stockholders

Mortgages, Bills of Sale

Property Appraisals by Outside Appraisers

Property Records

Retirement and Pension Records

Tax Returns and Worksheets

Trademark and Patent Registrations

Personal Documents To Keep For One Year

Bank Statements

Paycheck Stubs (reconcile with W-2)

Canceled checks

Monthly and quarterly mutual fund and retirement contribution statements (reconcile with year end statement)

Personal Documents To Keep For Three Years

Credit Card Statements

Medical Bills (in case of insurance disputes)

Utility Records

Expired Insurance Policies

Personal Documents To Keep For Six Years

Supporting Documents For Tax Returns

Accident Reports and Claims

Medical Bills (if tax-related)

Property Records / Improvement Receipts

Sales Receipts

Wage Garnishments

Other Tax-Related Bills

Personal Records To Keep Forever

CPA Audit Reports

Legal Records

Important Correspondence

Income Tax Returns

Income Tax Payment Checks

Investment Trade Confirmations

Retirement and Pension Records

Special Circumstances

Car Records (keep until the car is sold)

Credit Card Receipts (keep with your credit card statement)

Insurance Policies (keep for the life of the policy)

Mortgages / Deeds / Leases (keep 6 years beyond the agreement)

Pay Stubs (keep until reconciled with your W-2)

Property Records / improvement receipts (keep until property sold)

Sales Receipts (keep for life of the warranty)

Stock and Bond Records (keep for 6 years beyond selling)

Warranties and Instructions (keep for the life of the product)

Other Bills (keep until payment is verified on the next bill)

Depreciation Schedules and Other Capital Asset Records (keep for 3 years after the tax life of the asset)